If you haven’t yet heard about AI agents, you soon will.

AI agents are software programs that run autonomously and can make decisions and execute them without hand-holding. They are goal-driven digital worker algos powered by AI models.

AI agents don’t just give you answers, they take action. Think of them like a digital intern who never sleeps, learns fast, takes initiative, and doesn’t need health insurance.

You already know that you can use AI to suggest a perfect itinerary for your upcoming vacation. AI agents can go ahead and book the trip, cancel your calendar meetings, make the dinner reservations, text your spouse what they need to know, and remind you to bring your passport.

In the workplace they are going to change everything. The AI agent minimum wage is zero.

Some people use those walking escalators at the airport to walk super fast. Others use them so they don’t have to walk at all. This is how we think about embedding AI into our workflows.

Some are fearful that AI agents will lead to mass unemployment. Some are optimistic that AI agents will lead to new levels of innovation and progress. Here at BakStack, we’ll take a more pragmatic approach.

This is the first post of a series about how to use AI agents to level-up an asset management business.

Because AI won’t replace you. Your competitor who is learning about them first will.

This series identifies practical ways to embed AI into your workflow in four key areas:

Operations

Portfolio Management & Product Development

Legal & Compliance

Sales & Marketing

This first post in this series will focus on a practical and critical agent for ETF management, which will free up your capital market team to spend their time on more valuable initiatives.

This is an ETF monitoring agent for real time trading ETFMART.*

*If you would like to implement this agent for your company, just ask.

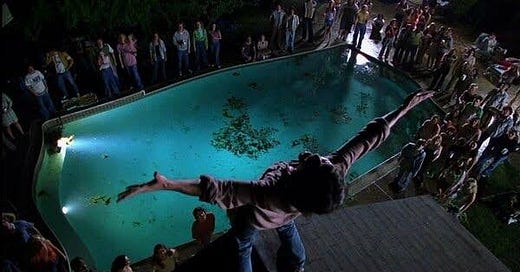

Back at Exponential ETFs, the Great Charles Ragauss built us this great widget where every time a trade went off above a certain size threshold, it would play this jingle

This was super fun, but it was also practical. If an ETF trade goes off outside of set bands - perhaps due to a fat finger or a hiccup at a market maker - then you are racing against the clock. Exchange trade bust rules stipulate that you have to file for a trade bust within 30 minutes of the trade happening. If you are out to lunch, you’ve missed out.

AI agents don’t take lunch. And they can identify a bad trade and file for bust in less than 3 seconds, let alone 30 minutes.

This is how the ETFMART AI agent works:

Keep reading with a 7-day free trial

Subscribe to BakStack to keep reading this post and get 7 days of free access to the full post archives.