Bluerock’s Bait-and-List Strategy

Shareholders were promised liquidity. Now, they’re getting it - at a cost.

Hey, real estate investors! You’ve tolerated my posts on entrepreneurship and tokenization and AI and even mindset. Your patience has been admirable, and it is about to pay off. I’ve got three jaw dropping real estate stories to bring you this week.

We’ll kick it off today with John Cox exposing Bluerock’s attempt to trap capital by converting to a CEF, and then we’ll hear from Charles Frischer on his activist campaign and efforts to return value to Regional Health Properties shareholders. Finally, my friend Chris Paul about a tokenized real estate deal gone wrong, and how he is building a platform that protects investors from those shenanigans.

-Phil

—

This post today is from our first guest author, John Cox. John is the CEO and Founder of Cox Capital Partners, a Philadelphia-based asset manager specializing in secondaries strategies. Founded in 2020, Cox Capital focuses on semi-liquid funds distributed through the wealth management channel, including non-traded BDCs and REITs, interval funds, and feeder funds.

You can (and should) subscribe to John’s newsletter here, and you can follow him and his team on LinkedIn here.

—

Bluerock Total Income Fund + Real Estate (TIPWX) shareholders are in a tough spot.

Facing over $1 billion in redemptions and a portfolio overallocated to illiquid assets, the fund is at a crossroads. But this isn’t a test of the interval fund structure, it’s a matter of incentives and portfolio construction.

Bluerock is asking shareholders to approve a fundamental shift: converting a semi-liquid, NAV-based interval fund into a traded closed-end fund. The pivot, which would create a permanent capital vehicle for Bluerock, reveals the true objective: raising and retaining retail capital.

Structure & Shareholder Liquidity

When interval fund redemption requests exceed available liquidity, redeeming shareholders are subject to proration, only receiving a percentage of the liquidity they requested in any given period. This is not unusual.

In fact, while proration can be frustrating for some, it’s generally a helpful feature that, in theory, protects funds from becoming forced sellers of their illiquid underlying assets.

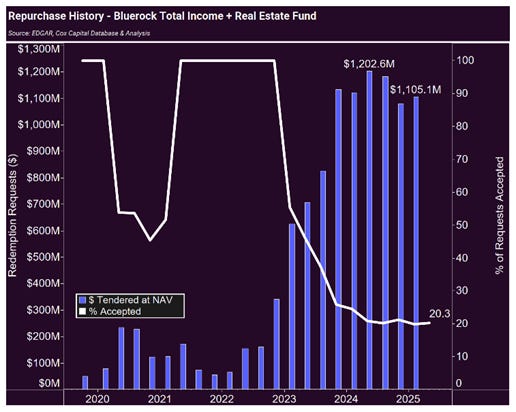

Since 2024, TIPWX shareholders have received 20% - 30% of requested redemptions each quarter.

Today, more than 25% of the fund’s $4 billion in net assets are now stuck in the redemption queue.

At this rate, assuming no new requests are added to the queue, Bluerock could work through the backlog in 5 - 6 quarters.

However, redemption trends suggest the queue will keep growing.

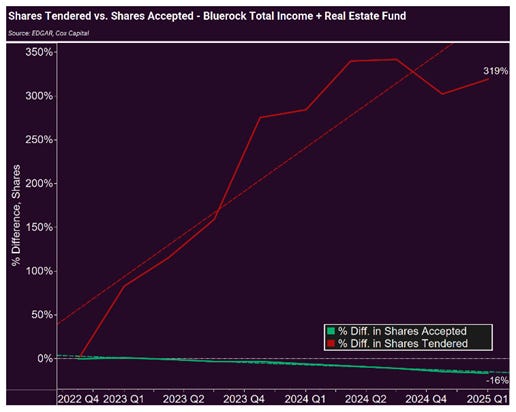

Since Q4 2022, total shares redeemed have increased 320% and shares accepted have dropped 16%. With requests and acceptances headed in opposite directions, the queue is unlikely to clear naturally, at least not anytime soon.

So far, none of this is really news. TIPWX is doing what it was designed to do, repurchase a predictable number of shares at predictable intervals. Simply put, despite the proration, the structure is working as intended – or at least how it was initially described.

So why list?

Sponsor Alignment

The fact of the matter is, even if the queue were to clear naturally, there is one important reality to consider: no sponsor is jumping through hoops to return over $1 billion of fee-generating retail capital.

By listing the interval fund, Bluerock will convert a semi-permanent capital vehicle into a permanent one. No capital is returned, at least not directly from the fund, so the $4 billion stays intact. Shareholders would gain daily liquidity, but only by trading with each other on the public markets, potentially at prices well below NAV.

That’s a far cry from the quarterly, NAV-based redemptions that shareholders signed up for.

Daily exchange-based liquidity is now being promoted as a feature of the proposed listing. But let’s be clear: investors who allocate to interval funds aren’t seeking daily liquidity. That’s what mutual funds are for.

More likely, shareholders were initially attracted to TIPWX, and interval funds generally, by the promise of illiquidity premiums, total return, and isolation from volatility. These are features best captured in a controlled, semi-liquid structure. The listing undermines that structure.

Strategic Justification

Yes, a permanent capital base ensures continued revenue for Bluerock.

But as noted in their Proxy Statement, the sponsor also presents a portfolio-based rationale for a public listing:

“Institutional real estate pricing has retreated to levels last seen in the wake of the Great Financial Crisis… creating an attractive environment to purchase assets, and correspondingly, an unattractive environment to dispose of assets. However, the Fund’s obligation to supply quarterly liquidity to fund the repurchase requests is creating a ‘Liquidity Mismatch,’”

So, was the mismatch caused by the fund’s liquidity obligation, or by how the portfolio was constructed?

TIPWX Portfolio

Composition: TIPWX is 105% allocated to private real estate funds. Some of these private funds have hundreds of millions worth of uncalled commitments and no liquidity mechanism, further impairing fund liquidity.

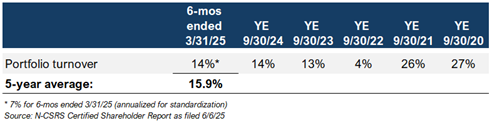

Turnover: Portfolio turnover is neither predictable nor sufficient to meet liquidity obligations. For the past five years, TIPWX has turned over 15.9% of its portfolio annually, well below the 20% annual pace implied by its 5% quarterly redemption policy. Meanwhile, performance has struggled.

Income: Yield hasn’t come to the rescue either. Dividend and interest income generated by the portfolio often isn’t enough to cover the Fund’s expenses, let alone provide liquidity and distributions to shareholders.

Game Theory & the Shareholder Dilemma

In our view, the upcoming proxy presents a false choice.

Shareholders can either:

A. Agree to the listing

Generate liquidity, likely at a significant discount to NAV

Allow TIPWX to avoid forced selling and focus on portfolio optimization

Create a permanent capital fee stream for Bluerock

B. Reject the listing

Force the fund to sell some of its $4 billion worth of private real estate funds at a discount

Trigger more redemptions and increased proration thereby extending the liquidity cycle

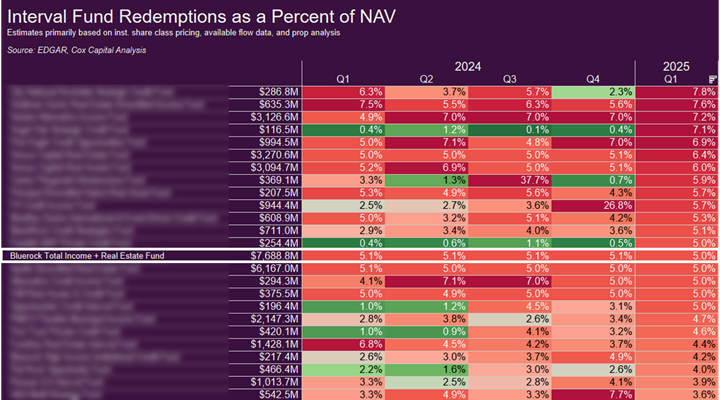

Other interval funds have handled redemption pressure with more discipline. Some have provided incremental liquidity. Others have tapped secondary buyers. Many have simply honored the structure as originally intended. This is not a structural failure. It’s a sponsor-level decision, and the rest of the industry is watching.

Rest assured: both mega and newly-seeded interval funds will be watching closely to see if this is a viable alternative for retaining fleeing capital.

Looking Ahead

The long-term success of retail alternatives hinges on alignment among Structure, Strategy, and Sponsor, the “three S’s” of product development and portfolio management. Most interval and lifecycle funds continue to manage that balance, even if imperfectly.

Bluerock, in contrast, has not managed that alignment. The structure (an interval fund), the strategy (levered exposure to highly illiquid assets), and the sponsor’s incentives (retain capital) are not compatible.

If this listing approach gains traction more broadly as redemption backlogs grow, what happens to advisor trust in interval funds?

Interval funds were built on a simple premise: offer periodic liquidity while protecting against forced selling and market volatility. That promise gave advisors a manageable framework for allocating client capital. Lifecycle funds offered the same, also with the initial transparency of targeting a potential listing on a national securities exchange.

If sponsors can rewrite the exit midstream, turning semi-liquid vehicles into listed equities, then the prospect of every semi-liquid NAV fund becoming a traded closed-end fund must become a more serious consideration for advisors who are considering an allocation to interval funds.

—