Math is beautiful. Math is provable. Math is certain.

Economics ain’t math. Where math is built on laws, economics is built in theories. Where mathematics truths last forever, economic truths last until the next S&P selloff. Math represents absolute truth, economics represents absolute opinion presented as truth.

Over the past several years I’ve been on a discovery of sorts, and I’ve taken on a number of identities out of curiosity, opportunity, necessity, or some combination. I have at different times been a market structure and capital markets guru, a financial product structurer, a tech founder, a small business advocate, an expert in quantifying customer satisfaction, an equal/inverse factor weight enthusiast, private REIT researcher and truth-teller, and now, standing at the intersection of ML and real estate investing.

“I is someone else” -Arthur Rimbaud

The one thing I never claimed to be is an economist. But these days, as an investor, there is no choice. These days, markets are being driven not by math but by the word choices of a 70 year old attorney and his band of often-wrong, over-educated, self-serious economists. There is no opting out.

So what do you do when you want to understand a field you neither love or respect? You develop a framework. You clear out the noise and try to think deeply about what the core truths are. What is clean. What matters.

And what is a clean and pure truth in economics? Well, I have no idea. Like I said, I ain’t no economist. But it seems to me that what resonates as true until I am convinced otherwise, is that free markets are the purest and most perfect form of capitalism.

Don’t ask me to explain it because I don’t think I can. So I’ll instead post a short six minute film I saw a decade ago which I’ve never been able to forget.

I, Pencil:

the spontaneous configuration of creative human energies of millions of people with their various skills and talents organizing voluntarily in response to human necessity and desire as if led by an invisible hand to promote an end which was no part of the intention

That is my framework. Beautiful, isn’t it? I think so. Clean and beautiful.

Which is to say that every instance of interference or manipulation by well-meaning economists carries unintended consequences, picks winners and losers, and messes up a perfect and clean system.

This framework, of course, puts me in direct opposition to the economic interventionists who believe they’ve solved the markets. They solved them, and they now know that a little tinkering with interest rates and QE and they can manipulate markets ever-higher, avoid recessions, and care not about debt, inflation, or unintended consequences.

Maybe they are right. Maybe this time is different. Maybe the economists have reached the pinnacle of enlightenment and thus managed markets are better than free markets.

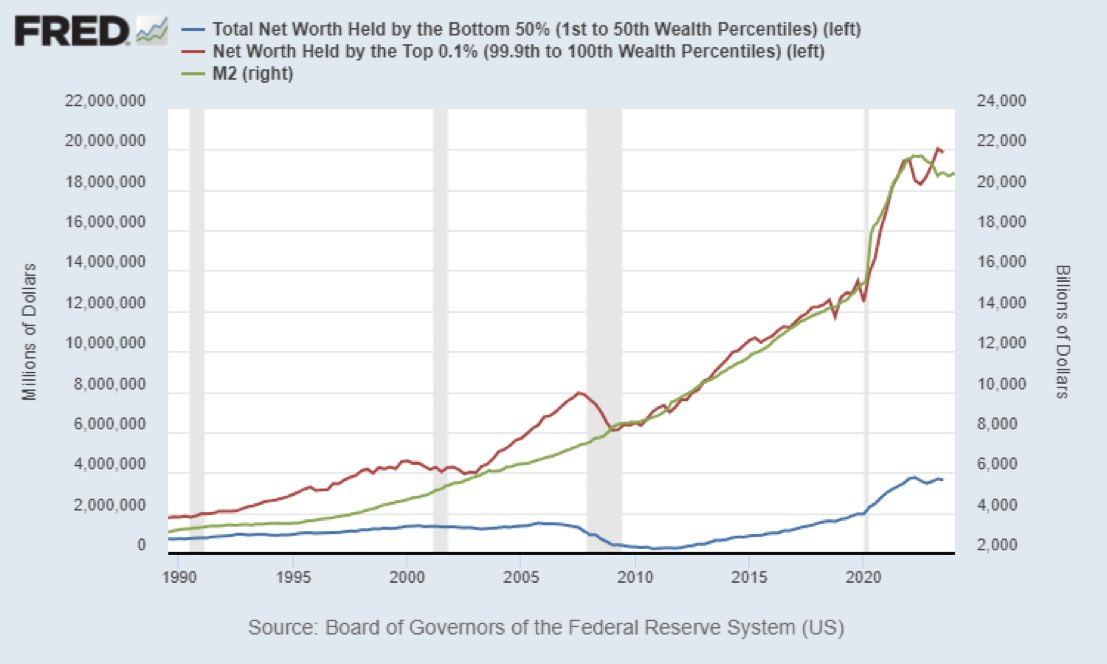

Indeed, asset prices are at all time highs.

Asset prices, however, do not tell the whole story. Assets are by definition owned by the rich.

Now look, most growth is positive sum, not zero sum. I will grant you that. I’m not here to bring some Marxist nonsense into the conversation. But when you consider that perfectly free markets are perfectly clean systems, you can see how every policy choice creates winners and losers. And it is not hard to see who the losers are.

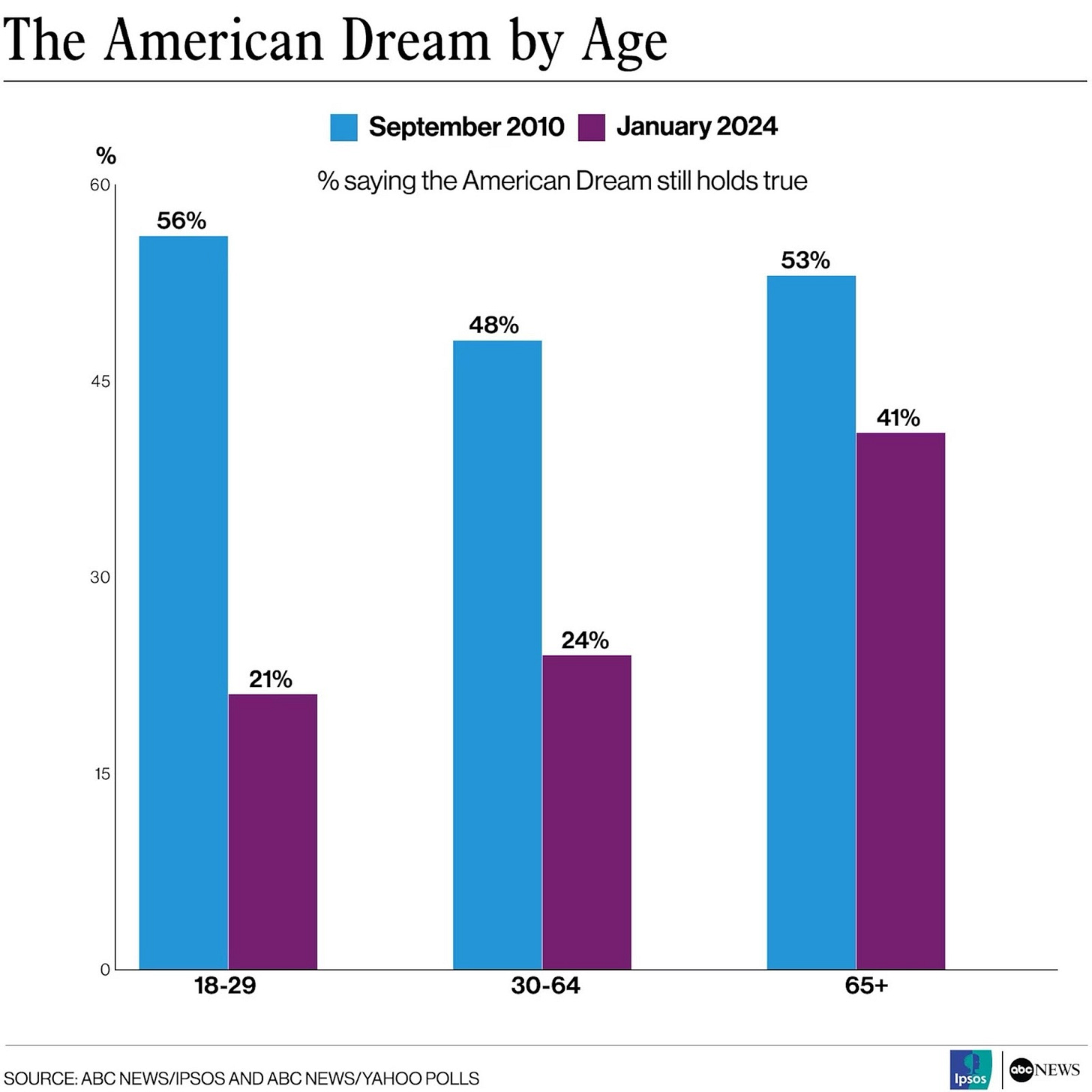

There are social consequences to these decisions. There are social consequences that are more important than financial ones. As younger generations are priced out of financial assets, as our debt service costs skyrocket, as inflation continues to eat away at purchasing power, wealth mobility becomes harder to achieve. You can’t climb a mountain while sliding backwards.

Belief in the American Dream is dying, and without that do we even have a unifying ethos that unites the country?

What’s more, we are seeing a massive spike in desperation bets and get rich quick schemes, from crypto to meme stocks to zero day options to sports betting. And why not? If getting rich slowly is unattainable you may as well try to shortcut.

So the market is on all time highs, and the Buffett Indicator (market cap to GDP) is too. The Fed claims that it’s mandate is price stability, but it seems to me that historically elevated valuations are anything but stable.

So I am no economist, but I got a sense of smell and I can tell you that what I’m smelling just don’t smell right. Hey, maybe i is an economist after all.

"I'm gonna get me a new Bob Dylan" -Bob Dylan

Have linked the I pencil story before, linking your article today @https://nothingnewunderthesun2016.com/

Special thanks to Quoth the Raven for sharing it,