One True Fan

Jim Ross is a legend. If you have ever worked in ETFs, you know. And if you don’t know, here is a short summary:

Jim was a fund accountant at State Street when an interesting project popped up. Someone was trying to IPO an index fund on the American Stock Exchange, and they needed a fund administrator.

It was a great concept, but the devil is in the details. And there were a lot of details. Operations, compliance, ‘40 act regs, market making, index and basket dissemination, SEC divisions of Investment Management, Corporate Finance, Trading & Markets, Finra, an IRS private letter ruling, more operations, more compliance, and so on.

Jim raised his hand. Jim figured it all out.

That project was SPY. And many, many more ETFs would follow the path that Jim had cleared.

Like I said, Jim Ross is a legend.

So you can imagine the level of imposter syndrome I felt being asked to join an industry panel alongside Jim Ross to talk about ETF platforms and distribution.

Not today, imposter syndrome. I may not have State Street’s AUM but I do have some things to say.

The panel kicked off with Jim telling a story about State Street’s partnership with DoubleLine and the TOTL launch. A large wirehouse platform initially said that the fund would not be granted access, but after several advisors demanded access the gatekeeper approved the fund in just a couple of days.

The point here was that even though the fund industry complains about exclusionary practices that deny access to new and independent fund managers, for the right fund those gates will open.

And he’s right.

It was no coincidence that advisors demanded access to the DoubleLine fund. DoubleLine has built a brand. They earned a brand. DoubleLine’s CEO/CIO Jeffrey Gundlach earned that brand and earned trust by being bold, honest, and mostly by being authentic. He had True Fans.

The True Fans were the advisors. They wanted him to manage their bond exposure. So they called, they asked, they demanded, and they got the access they needed.

A brand for a company is like a reputation for a person. You earn reputation by trying to do hard things well. -Jeff Bezos

This distribution thing is a strange one. Over the past few years I’ve been pitched by all kinds of salespeople and consultants looking to get paid in exchange for getting us platform access. When I ask how they plan to do it I always get some variation of “my college roommate's brother-in-law is neighbors with this or that gatekeeper”. Rarely do they bother to ask about the fund in question.

It is, quite frankly, revolting.

But it’s also all wrong. It is not a matter of distribution. It is a matter of product development. It is a matter of building a fund demonstrably better. And, just as Jim Ross described in the case of DoubleLine’s approval, a matter of having True Fans.

The 1000 True Fans concept was introduced by Kevin Kelly fifteen years ago and it’s as relevant today as it ever was.

The concept is that any creator or entrepreneur only needs 1000 dedicated and loyal fans to make it. Those fans will not only support everything you do, they will also form a community of passionate missionaries, spreading the word for you. A volunteer army of salespeople.

If you can find 1000 True Fans, you’ll make it.

And when it became my turn to speak on this panel, that is what I said. Don’t worry about the gatekeepers, don’t worry about the right salespeople and their brother-in-law’s neighbor. Find your True Fans. Everything else will follow.

Let’s be honest: most funds don’t have 1000 True Fans. Most funds don’t have One True Fan. And that’s getting worse.

Just as the quality of movies has declined ever since creative discretion moved from the artists to the business managers, the same has happened in the fund space. You can de-risk a movie investment by making another Spider Man. And you can de-risk a fund launch by issuing the trendy strategy that worked last year.

But you’re not going to find True Fans that way.

Am I somebody’s favorite fund manager? Is someone willing to tell all their friends, demand gatekeeper access, and be evangelical? Do I have one missionary? One?

I don’t believe I do, not yet. But I will. I won’t rest until I do.

That is my distribution strategy. To be better. To create value. And if I can become someone’s favorite fund, I can become a thousand people’s favorite fund.

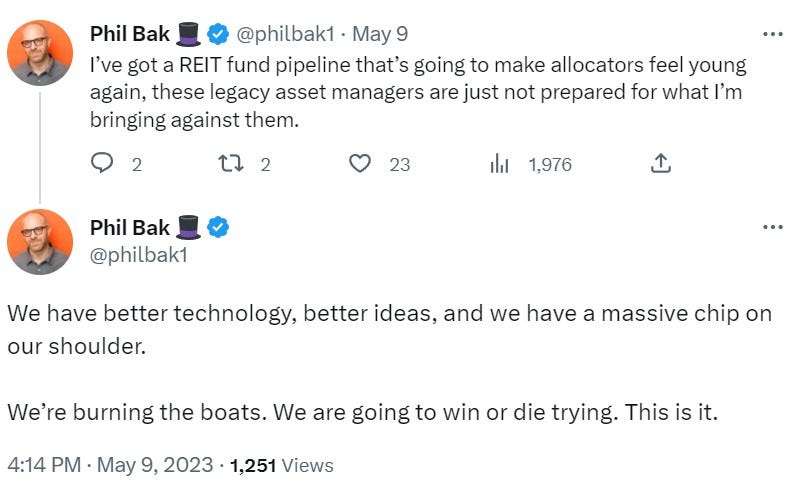

I have a fund coming that we think is substantially superior to some of the largest private REIT funds - and we will show our math on this (stay tuned!).

I have machine learning models that go deeper into factor analysis and timing than anything I have ever seen.

We are building. We are laser focused on finding the signal from the noise, and on investor outcomes. We are a REIT asset manager trying to be your favorite REIT asset manager. That’s our goal. That’s our mission.

We want One True Fan, and that fan is you.

Love how you write Phil 👍