Eden is burning

either brace yourself for elimination

or else your hearts must have the courage

for the changing of the guards

-Dylan

Even Facebook got so sick of Facebook they needed to pivot.

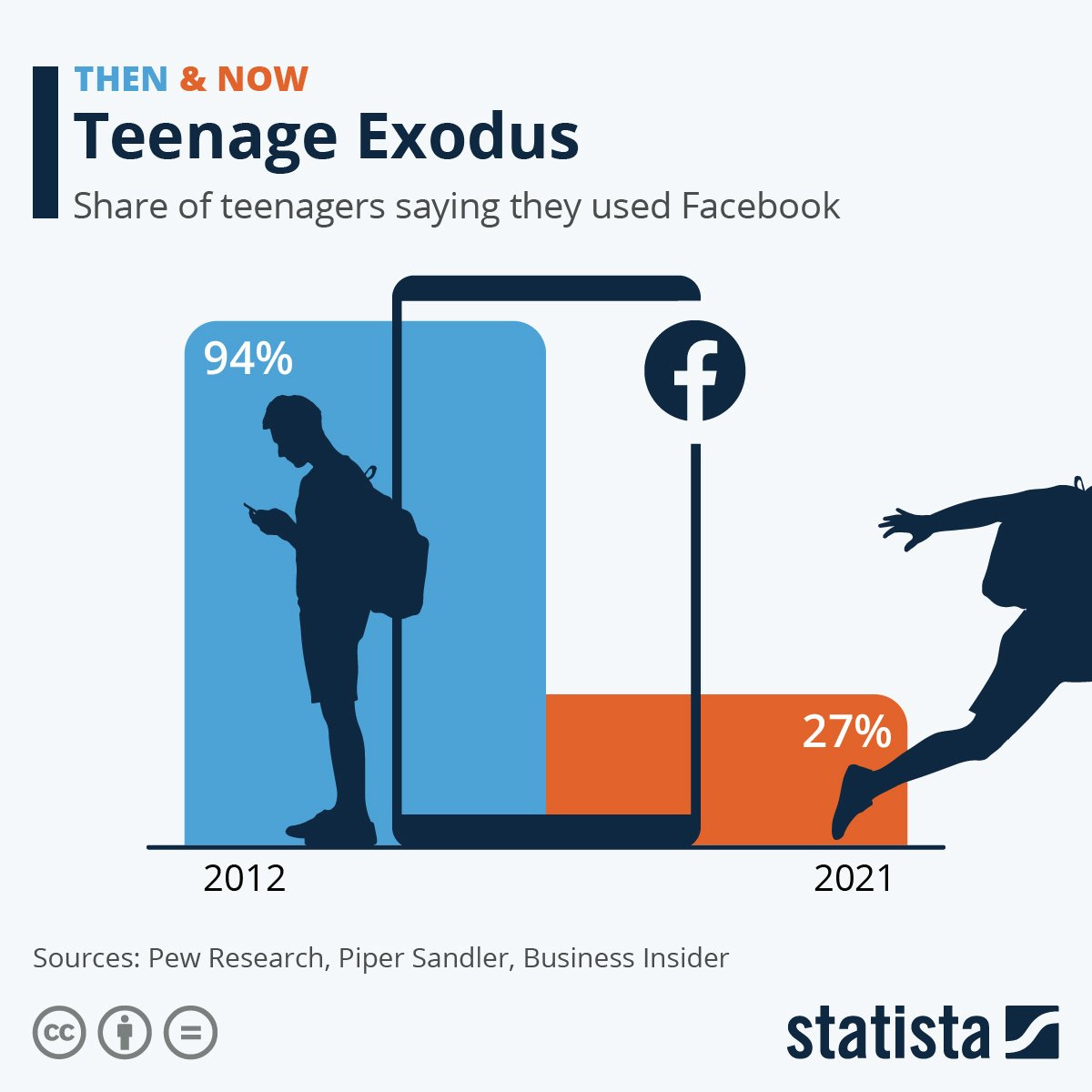

Facebook the stock came into the year as the #1 holding by hedge funds and a valuation of $850 Billion. Facebook the company came into the year tired and embattled as it fends off antitrust attacks at home, restrictions on data gathering abroad, and an aging user base.

The company had just announced a rebrand to Meta, and a refocus to creating some kind of digital dystopian prison they are calling the metaverse. Ok.

None of this should be a surprise. Facebook’s initial growth was built directly on top of the grave of myspace, which died the death of becoming uncool. Fashion changes, trends change, and no one wants to be on their grandmother’s social media platform.

Market preferences also change. Market-capitalizations change. There is a natural ebb and flow to these things, and just as IBM and Exxon gave way to Apple and Amazon, Apple and Amazon will also give way to a new crop of companies in the future. It is mesmerizing to see:

And let’s shed no tears for Facebook. This is a company that has contributed to a teen suicide crisis, and covered that up. This is a company that has lied to it’s users, abused our data, violated anti-trust rules, and turned neighbors against each other furthering political divisions. So naturally, it is the 5th largest ESG fund holding.

And then, the natural ebb and flow of things. Just as the tide goes out and the sun sets at the end of every day, just as the leaves die off each fall, mighty companies see their stature diminish.

The changing of the guard is coming. Not just to Facebook and not just to the rest of the FAANG stocks. The era of the baby boomer is coming to an end. We are on the cusp of an unprecedented generational wealth transfer. Media power is shifting from legacy gatekeepers to podcasters and social media stars.

Our political leaders will soon be retiring: Joe Biden is 79 years old. Donald Trump is 75. Nancy Pelosi is 81. Mitch McConnell is 79. Janet Yellen is 75. Jerome Powell is a young 69. I could go on forever. In politics and in markets, you better get ready for the changing of the guard.

Market cap weighted index investing works best when things stay the same. When the largest companies get larger and when the smallest companies fail to break through. It is a strategy that profits off the status quo.

Reverse market cap weighting works best during a changing of the guard. Reverse cap systematically under-weights the companies that can only be displaced while over-weighting the ones ready to take their place.

Facebook came into the S&P500 in late 2013 at a 50 basis point allocation. Today, after it’s recent sell-off, it is at 230 basis points.

Facebook came into the Reverse-Cap S&P500 index in 2013 as an over-weight. It is the second smallest company out of 500 in the index today. Less than one basis point of exposure.

Reverse market cap weighting works best in periods of mean reversion, and in periods of change.

Market cap weighting has done very well for investors, for a very long time. But brace yourselves and get prepared, because here comes the changing of the guard.