The Model Movement

Funds are no longer the product - the model portfolio is. It’s time to shift your distribution upstream.

"The moment of critical mass, the threshold, the boiling point."

-Malcom Gladwell, The Tipping Point

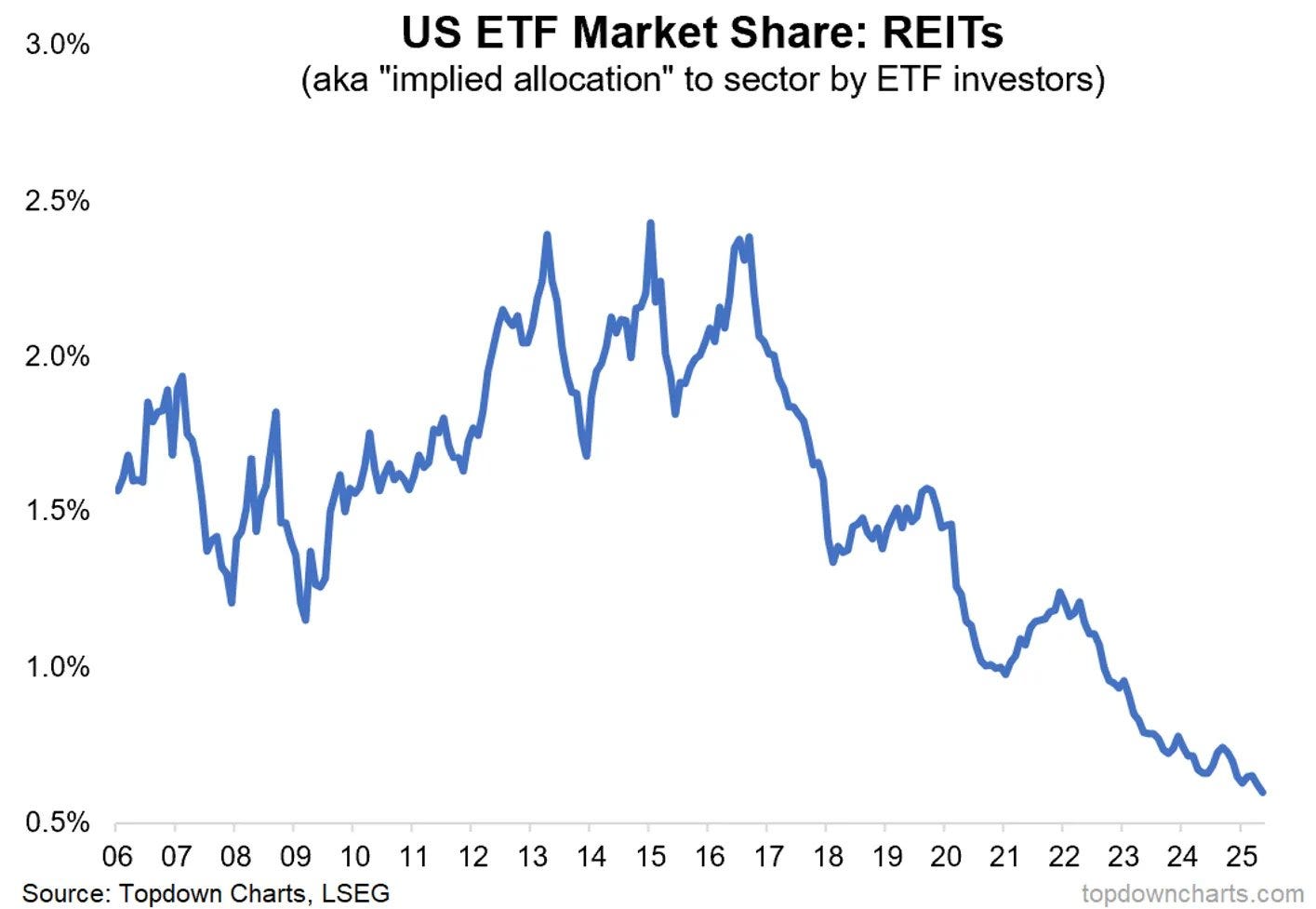

Sometimes you see a chart that just smacks you in the face. This was one of those charts. REIT portfolio allocations down to about a half a percent.

I spent two years trying to sell this little, tiny, sliver of allocation. And we knew this, more or less, we had our reasons. Good reasons. But still, seeing this chart really made me stop and think: why sell a half a percent, when you can sell the whole damn thing?

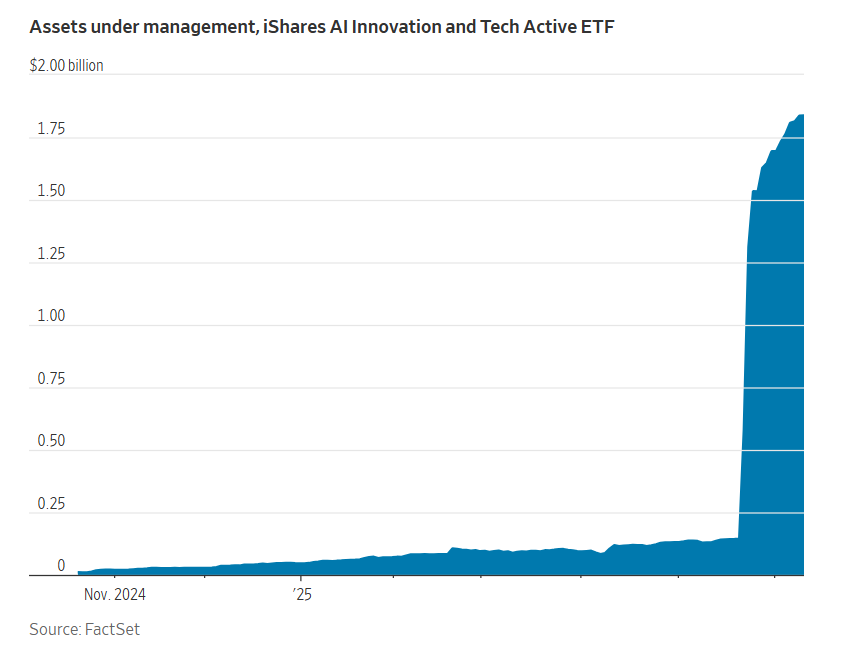

The WSJ recently wrote an article about how BlackRock’s iShares AI Innovation and Tech Active ETF jumped from $144 million in assets to $1.5 billion in just three days.

What changed? It got added to the model.

More than 80% of advisors now use models, yet advisor-built portfolios are down from 41% to 23%. This is what centralization looks like.

And it is exacerbating. More than 70% of new flows are going directly into models.

Model portfolio flows are structural. The trend is accelerating, and it is irreversible.

Model portfolios can adjust to trends like direct indexing, or tokenized funds by simply reallocating to newer underlying funds. They can allocate to alternative assets. And they are more nimble than bottom-up funds.

The real power is in the defaults. Model portfolios are becoming the default setting for how capital is allocated in the advisor channel.

Inertia is destiny. For fund managers, if you're not in the default, you're not in the game. If you're not embedded now, every quarter that passes compounds your irrelevance.

This is the tipping point. It might be a decade in the making, but the velocity is still speeding up. So let’s dive in and make sure we understand exactly what is going on, and how asset managers can win in this environment.

Many legacy fund managers still imagine a world where performance drives flows, where relationships move money, and where branding wins shelf space. That world is gone.

If you're not in the default model, you're not in the market. Models have become the invisible hands of portfolio construction—pulling the levers on trillions in advisor-directed capital. And they do it quietly, efficiently, and without ceremony.

According to Broadridge, over $8 trillion in assets now sit inside model portfolios—expected to exceed $13 trillion by 2029. That’s more than the entire U.S. mutual fund industry had 10 years ago.

Advisors aren’t choosing. They are clicking.

Keep reading with a 7-day free trial

Subscribe to BakStack to keep reading this post and get 7 days of free access to the full post archives.