The SAAS Crash

Markets are cyclical and crashes are inevitable, but the software industry will never be the same.

“Seven years of great abundance are coming throughout the land, but seven years of famine will follow them.” Genesis 41:29–30

Nothing lasts forever, especially not in markets. Markets are inherently cyclical, just like seasons and patterns throughout nature. So when markets crash, it’s not always because something went wrong. It could be that something went right, just for too long.

The S&P’s trailing P/E is 29.18, versus the long term mean of 16.19. The CAPE Ratio is 39.6 versus a long term mean of 17.33. The Buffett Indicator is 222%. We’ve been riding high. This was overdue.

Bull markets take years to build up. Corrections come quicker. And there is an asymmetry to it. The higher the run-up, the harder the fall.

Silver fell by 21% in just 24 hours.

Bitcoin has been cut in half from all time highs, and is now down 28% over the past month.

Something systemic likely broke, but we don’t know what yet.

And unfortunately, the losses aren’t limited to metals and crypto.

Amazon’s awful earnings report last night caused a 10% drop pre-market. We’ll see where it opens up this morning. Keep in mind that AMZN is 3.85% of the S&P. It is almost 5% of the Nasdaq 100. Contagion will be everywhere.

The most haunting sector in this sell-off is software. SAAS multiples are down big. Adobe, Salesforce and Workday are down 15% over the past month. Hubspot, Figma, Oracle and Snowflake are down 30%.

I say that software is haunting because SAAS (software as a service) is somewhat of a bogie for the Venture Capital market itself. It’s not only VC, it is also where the US dominates from a global perspective. And, from a valuation standpoint, it’s got the most room to fall.

The SAAS Crash is also haunting for another reason entirely.

John Armstrong is a steady hand. It’s one of the things I love about him. John is my co-founder at Skyline, and while Chris Paul and I can get emotional, John brings a steady calm to the team. Each day same as the last. John doesn’t get rattled.

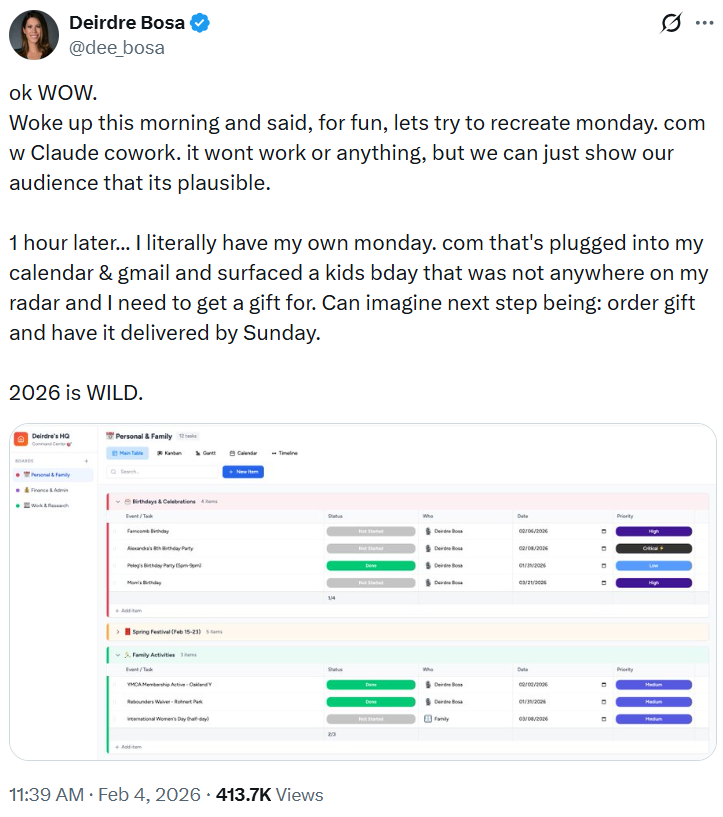

John was rattled. He was playing around with the newly upgraded Sonnet 5 and Opus 4.5 and Claude Code and he was rattled. “Phil, everything built yesterday can be done twice as fast and for half the cost today, and it’s getting exponentially faster and cheaper at a rate I can’t even process”.

AI went from talking to doing. This is the big game changer.

These AI coding tools aren’t a productivity boost. They are a cost-curve inversion. Years of expert design, coding, testing, and docs now collapse into minutes of conversation. The business of software shifts from typing syntax to supervising intent.

Teams flatten, juniors fade, seniors become architects, and judgment replaces code as the scarce resource.

This is not bullish for incumbents. It is catastrophic.

This is not catastrophic for startups. It is bullish.

This is what disruption looks like. Embrace it.